- CALCULATING OPERATING CASH FLOW HOW TO

- CALCULATING OPERATING CASH FLOW PLUS

- CALCULATING OPERATING CASH FLOW FREE

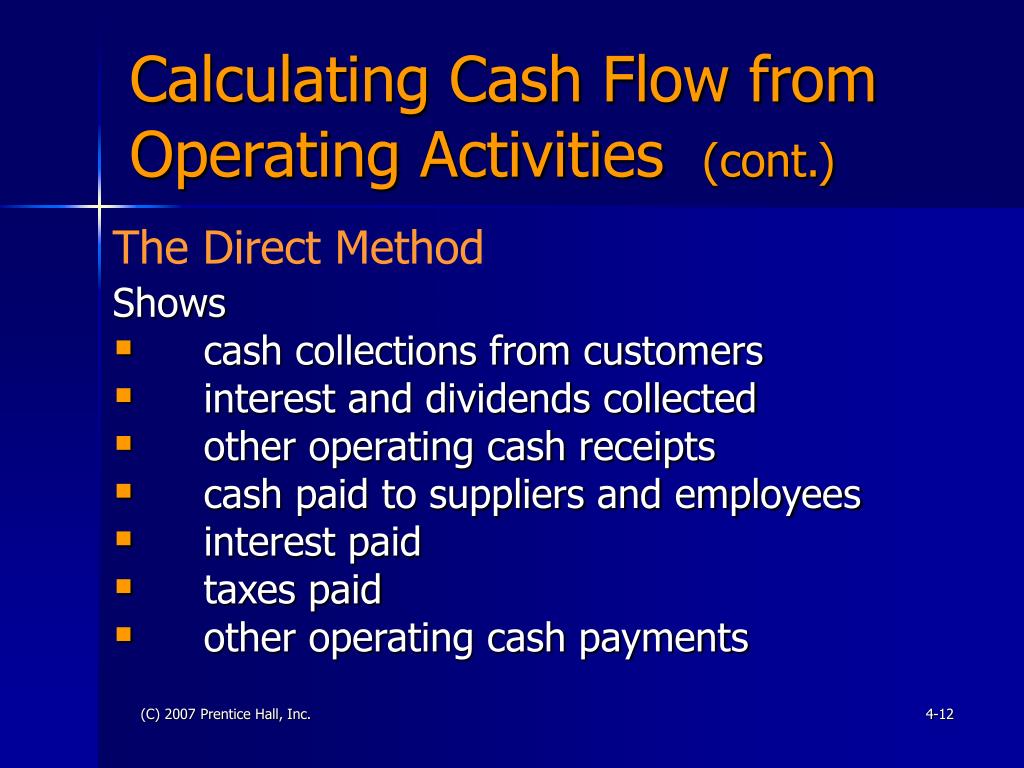

For instance, it might keep tabs on cash paid to suppliers and vendors, workers, and tax authorities when measuring out-flows, and sources of income, such as sales and dividends, when measuring in-flows. The other method is for the company to record all transactions in cash and summarize its cash position for a particular accounting period on that basis. This extra cash would need to be added back to net income to produce the OCF statistic. Therefore, it must be subtracted from the net income.īy contrast, accounts payable implies that the company has incurred expenses, but they have not yet been paid. The reason accountants call it “indirect” is because OFC is inferred from the company’s net income position.Īn increase in accounts receivable, for instance, indicates that the firm has earned money, but the cash has not yet been received. The indirect method of calculating OCF takes net income and applies various correction factors to it, reflecting the status of non-cash accounts, such as accounts payable, accounts receivable, and capital depreciation. There are two methods of calculating OCF: indirect and direct. Indirect and Direct Methods for Calculating Operating Cash Flow This expanded definition of a company’s cash flow avoids the artificial deflation of its total cash reserves, which often appears after working capital increases are taken into account.

CALCULATING OPERATING CASH FLOW FREE

To remedy this, firms also report free cash flow (FCF).

For instance, if capital spending is high and the company applies accelerated depreciation, the operating cash flow will appear chronically low even if the business has enough cash on hand to meet all its needs. However, if the firm cannot collect the money, perhaps because the client pays late, it has no cash inflows – something that a look at the OCF will reveal.Įven so, operating cash flow isn’t always helpful for measuring the financial solvency of a firm. On its year-end profit-and-loss statement, it will record the sale as revenue, making the company appear healthy. The beauty of operating cash flow is how it strips out various factors that get in the way of assessing the core health of a business.įor example, a company may have just made a large sale and is waiting for money to enter its accounts. Why Would a Company Use Operating Cash Flow?

It lets them separate their primary business activities from other factors that influence their balance sheets, telling them how much money they have to play with at any given time. Operating cash flow enables firms to track cash flows in and out of their business accounts during regular operations.

However, once you understand how OCF works, you’ll quickly see the value it offers. That’s because most people are used to thinking in terms of profit and loss.

CALCULATING OPERATING CASH FLOW HOW TO

How To Understand OCF in AccountingĪt first, operating cash flow seems like a complex topic. Subtracting preferred dividends (if the company offers them) is essential for calculating this statistic because these shareholders receive cash first. You can also calculate operating cash flow per share to see how much revenue each chunk of equity is generating:Ĭash Flow Per Share = ( OCF – Preferred Dividends) / Common Shares Outstanding Operating Cash Flow = Net Income + Non- Cash Expenses – Increase In Working Capital To calculate operating cash flow, you can apply the following operating cash flow equation: It provides a real-time view of their current cash position, regardless of their end-of-quarter profitability. Operating cash flow, along with free cash flow and net income, helps companies determine their financial health.

CALCULATING OPERATING CASH FLOW PLUS

The operating cash flow formula is as follows: net income plus non-cash income, adjusted for changes in working capital, revealing total cash generated and spent in a given period. Companies receive money from customers and clients and then use it to fund wages, rents, bills, marketing, and other services. Operating cash flow is the cash that businesses generate during normal operations. We’ll also discuss two different methods for calculating OCF. This post will give you the definition of operating cash flow (OCF) and then provide an example. In business, you will frequently come across the term “operating cash flow.” What does it mean, though?

0 kommentar(er)

0 kommentar(er)